vermont sales tax food

An example of an item that is exempt from Vermont sales tax are items which. Vermont state does have local sales tax so.

Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

. 9701 31 and 54. Candied apples and cotton candy food and beverage supplied by a restaurant french fries onion rings fried dough. Meals and Rooms Tax Return.

It should be noted that any mandatory gratuities of up to 15 and all. If you must pay sales and use tax for multiple locations or if your total sales and use tax remitted for the year will exceed 100000 the Commissioner of Taxes has mandated that you use. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

Vermont Meals Tax Exemption Certificate for Purchases of Meals For Resale. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Soft drinks however do not include milk or milkmilk substitute.

Since sales tax rates may change we advise you to check. Another example is food sold. 9741 13 with the exception of soft drinks.

Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. In the state of Vermont they are exempt from any sales tax but are considered to be subject to the meals and rooms tax. The Williston Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Williston local sales taxesThe local sales tax consists of a 100 city sales tax.

A sales tax of 6 is imposed on the retail sales of tangible personal property TPP unless exempted by Vermont law. Vermonts latest tax restructuring proposal addresses neither of these concerns -- it offers no substantive plans to fairly redistribute sales taxes on food. Vermonts state-wide sales tax rate is 6 at the time of this articles writing with local option taxes potentially adding on to that.

For more information on Vermont Sales and Use Tax and exemptions see Vermont law at 32 VSA Chapter 233 and Vermont regulation at Reg. Vermont Sales and Use Tax Sales Tax. 974113 with the exception.

Food Food Products and Beverages Exempt Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. This page describes the taxability of. Vermonts food and beverage sales tax exemption does not extend to soft drinks or sweetened beverages.

Counties and cities can charge an additional local sales tax of up to 1 for a maximum possible combined sales tax of 7. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax.

In Vermont certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Vermont has a statewide sales tax rate of 6 which has been in place since 1969. FOOD FOOD PRODUCTS AND BEVERAGES - TAXABLE.

Meaning you should be charging everyone in your state the rate where the item is being delivered. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. PA-1 Special Power of Attorney for use by.

Tax rates can vary based on the location of your business and the location of your customer plus the levels of sales tax that apply in those specific locations. Vermont first adopted a general state sales tax in 1969 and since that time the rate. The sales tax rate is 6.

Effective July 1 2015 soft drinks are subject to Vermont tax under 32 VSA. Vermont Use Tax is imposed on the buyer at the same rate as the sales taxIf you are a new business go toGetting Started withSales and Use Taxto learn the basics of Vermont Sales and Use Tax. But there is endless.

An example of items that are exempt from Vermont sales. Here are examples of food items subject to Vermont Meals and Rooms Tax. The state-wide sales tax in.

Vermont is a destination-based sales tax state. Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. Sales tax is destination-based.

Vermont Bun Baker Cookstove Baker S Oven Tiny Wood Stove Wood Stove Cooking Wood Stove

Favorite Maine Recipes Poster Excuse The Comic Sans Font I Ve Got Maine On The Mind Maine Food Recipes

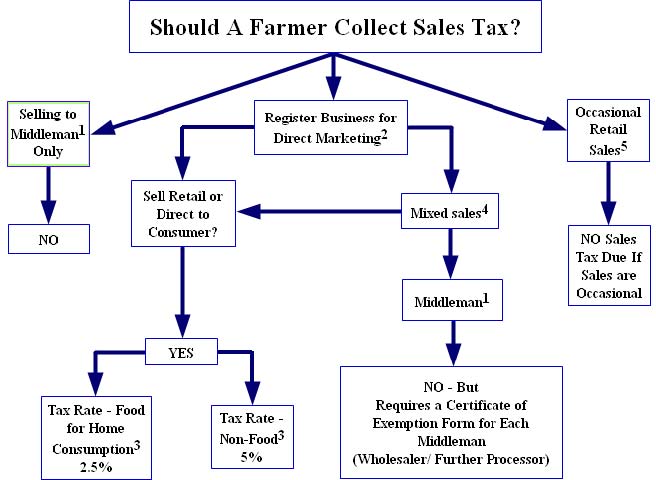

Direct Marketers And The Virginia Sales Tax

Mighty Tasty Granola Organic Granola Granola Wild Rose Detox Recipes

Vermont Sales Tax Small Business Guide Truic

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

What Transactions Are Subject To The Sales Tax In Vermont

Vermont Agriculture Food System Plan 2021 2030 Resources Vermont Farm To Plate

Sales Tax On Grocery Items Taxjar

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

Flowers Foods Acquires Shuttered Bakery Facilities In Vermont Food Manufacturing

This Map Shows The Most Talked About Fast Food Burgers In The Us Map Pictorial Maps Us Map

Push Is On To Expand Vt Sales Tax To Services Ethan Allen Institute

Vermont Agriculture Food System Plan 2021 2030 Resources Vermont Farm To Plate

Impressioni Artistiche Hunter Eddy Still Life Still Life Painting Still Life Art